by Deidra Fulton | Dec 19, 2016 | Uncategorized

Clients sometimes mention their employer offers a ROTH arm in the 401(k) plan and ask if they should choose that over the pre-tax option.

The answer to this question depends upon each situation, but, yes, ROTH arms can be attractive. It’s almost like asking, “What’s the best ice cream flavor?” It depends upon your circumstances and preferences.

by Deidra Fulton | Oct 28, 2016 | Uncategorized

October is National Cybersecurity Protection month. So it’s the perfect occasion to consider how you might strengthen the precautions you take when you’re online to reduce the potential for becoming a victim of cybersecurity crimes.

Let’s start with a few basics when you’re online:

by Deidra Fulton | Sep 25, 2016 | Uncategorized

A big surprise may lie ahead for seniors who itemize medical expense deductions on their federal tax return beginning on January 1, 2017.

One of the provisions included in the Affordable Care Act legislation passed by Congress in 2010 raised the floor for medical expenses that could be taken as itemized deductions from a threshold which exceeded 7.5% to a new threshold of 10% of

by Deidra Fulton | Aug 29, 2016 | Uncategorized

News reports of devastating flooding following very heavy rains in recent days show how easily lives and memories accumulated over a lifetime can forever change – and quickly – for those who are impacted by floods.

Some homes in areas that were nowhere near a body of water and which had never had any threats from flooding in the past became surprise victims of flooding for the very first time ever.

by Deidra Fulton | Jul 25, 2016 | Uncategorized

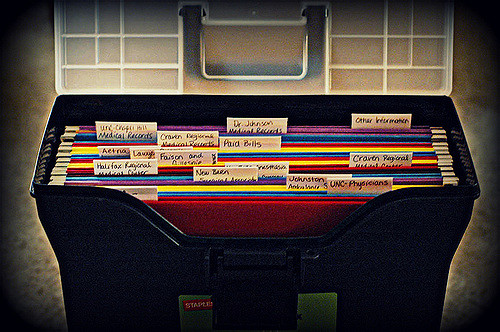

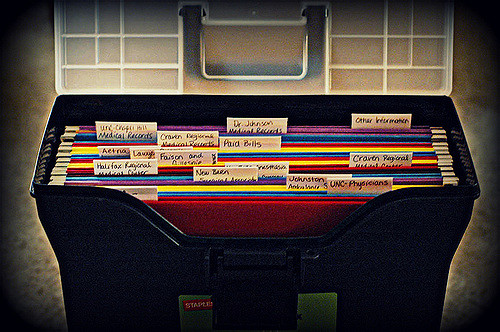

Over the past few months I’ve realized that I’ve fallen into poor habits when it comes to keeping my personal financial records organized. It’s so easy to let a month’s documents awaiting attention slip by when we’re very busy. Or worse, to create a new ‘stack’ of items because there’s simply no room to jam one more statement into the file cabinet.