Over the past few months I’ve realized that I’ve fallen into poor habits when it comes to keeping my personal financial records organized. It’s so easy to let a month’s documents awaiting attention slip by when we’re very busy. Or worse, to create a new ‘stack’ of items because there’s simply no room to jam one more statement into the file cabinet.

So while I do have a ‘system’ for organizing my records, I still need to remind myself from time to time how and why the system works. I thought you might also benefit from these tips for staying on top of important financial records.

Create Your System

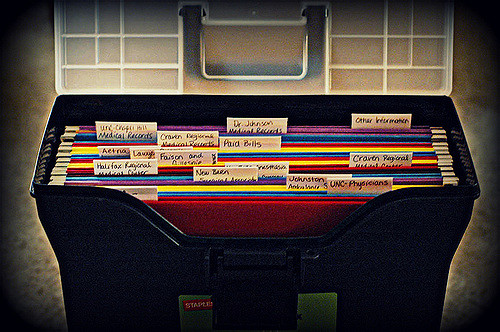

Storage is the foundation of a good system. Deciding where to keep your records and documents depends on how quickly you want to be able to access them, how long you plan on keeping them and the number and type of records you have. A simple set of labeled folders in a file cabinet may be fine for many. Electronic storage is another option for certain records if space is tight or if you prefer to receive and view records online. No matter which storage option(s) you choose, try to keep your records in a central location.

Build the Structure

Next, you need to structure the file folders within your storage system. You may choose to structure your files around the major areas of your financial life, such as Budget, Investments, Insurance, Retirement, Taxes and Work, by creating a separate folder for each. Here’s what that might look like:

- The Budget folder would contain expense summaries, bills and financial institution statements.

- The Investments folder would include statements and financial transactions related to all investment accounts (including retirement savings accounts).

- The Insurance folder would include information on the most recent insurance coverages, including health, disability, long term care, life and property and casualty.

- The Retirement folder would include information on any future pension benefits, social security projection statements and the like.

- The Taxes folder would include all data related to federal, state or local income taxes, property taxes and similar items.

- The Work folder would include pay stubs and other employment-related information.

File Away

After having created and built the basic system, you’re ready for the next step: creating a process for collecting, reviewing and filing financial documents. If you receive financial statements through the mail, set up a collection point such as a basket or in-box. Open and read what you receive and then decide whether you can file it or discard. If you receive statements electronically, pay attention to any notifications you receive. You may decide to set aside a specific time each week or each month dedicated to filing items. Once you get in a routine, you’ll likely find that keeping your records organized takes very little time each week or month.

Purge Routinely

Keeping your financial records in order can be even more challenging than organizing them in the first place. Let the old phrase “Out with the old, in with the new” be your guide. For example, when you get this year’s auto renewal policy, toss out last year’s. When you receive an annual investment statement, you may decide that you no longer need to keep monthly or quarterly statements for that account. It’s a good idea to review your files at least once each year to keep your filing system on track. Better yet, set aside a designated time each year to purge those files!

Think Safety

Don’t just throw hard copies of financial paperwork in the trash. To protect sensitive information, invest in a good quality shredder and destroy any document that contains account numbers, social security numbers or other personal information. If you’re storing your records online, make sure your data is encrypted. Use strong passwords and back up any records that you store on your computer.

Taking some time to create, organize and monitor your financial recordkeeping system will provide many rewards, plus reduce the amount of time and stress you spend in looking for items in the future.

Have questions about your financial records or how well you are progressing toward meeting your financial goals? Give us a call. We’re always here to help.

Image credit: Becky Wetherington

Portions of this article adapted with permission of Broadridge Forefield Investor Communications